Key Takeaways

- ADP Employment misse.

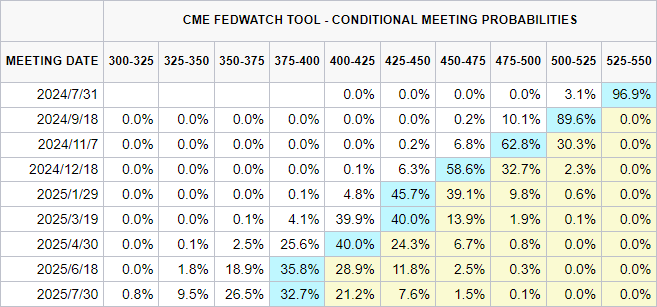

- MUFG sees Fed to signal Sep. rate cut.

- Goldman CEO revises view on Fed rate cuts.

- Chip stocks surge in pre-market trading.

- AMD collaborates on AI accelerator, challenging Nvidia.

- Microsoft’s Copilot drives major GitHub income growth.

I. Market Report

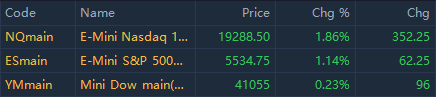

Stock futures rose Wednesday as investors parsed the latest earnings reports and readied for the Federal Reserve monetary policy decision.

As of 08:21 am, EST (or 08:21 pm in Malaysia), futures tied to the Dow Jones Industrial Average were up 0.23%. S&P 500 futures popped 1.14%, and Nasdaq-100 futures climbed 1.86%.

II. Market Movers

As of 08:21 am, EST (or 08:21 pm in Malaysia), top pre-market movements are as follows:

| Ticker | Chg. | Company |

| NUZE | 69.45% | $NUZEE INC NUZE$ |

| PMEC | 59.06% | $Primech Holdings Ltd. PMEC$ |

| MHUA | 37.86% | $Meihua International Medical Technologies MHUA$ |

| JTAI | -18.95% | $Jet.AI Inc. - Common Stock JTAI$ |

| MGNX | -24.58% | $MacroGenics, Inc. MGNX$ |

| FGEN | -44.67% | $FibroGen, Inc. FGEN$ |

Note: We are pleased to inform you that our app now supports pre/after-market trading for US stocks. The trading hours for these sessions are as follows:

- Pre-market: 16:00 to 21:30 in Malaysia

- After-hours market: 04:00 to 08:00 the next day in Malaysia

Please note that regular trading hours are from 21:30 to 04:00 UTC.

III. Flash Headlines

US July ADP Employment Up 122,000, Missing Estimates

ADP reported the US private sector added 122,000 jobs in July, missing the expected 150,000. The prior month's figure was revised up to 155,000 from the initially reported 150,000. The lower-than-expected July reading could signal a potential slowdown in the US labour market.

According to Forexlive, the overall weakness in the US employment market signalled by the lower-than-expected ADP data is mild, it should give the Federal Reserve more confidence that it is time to signal policy normalization. The analyst suggested the tepid jobs report could embolden the Fed to take further steps towards normalizing monetary policy.

Goldman CEO Shifts, Now Sees Fed Cutting Rates Once or Twice in Year

Goldman Sachs Group Chief Executive David Solomon said the Federal Reserve could cut interest rates once or twice later this year, a departure from his forecast two months ago that there would not be any cuts through 2024. Read in detail>>

MUFG: Fed to Confirm Market Expectations of Sep. Rate Cut

Mitsubishi UFJ Financial Derek Halpenny, head of research at the group, said in a report that the Fed's communication at Wednesday's policy meeting will be important not only for the reaction of bond yields, but also for the reaction of overall market conditions. Read in detail>>

Experts Warn Hidden Debt Bubble Could Trigger Financial Tsunami

A senior economist and investment expert recently warned that the stock market may be forming a very destructive debt bubble, and its potential losses could have a shock effect on the entire financial system. Read in detail>>

US Bond Sales Sizzling, Fund Managers 'Dare Not Leave Computer' Even on Vacation

For asset-backed securities, which are the most popular, sales this summer have averaged higher than the rest of the year. Read in detail>>

IV. Stocks to Watch

US Semiconductor Stocks Gain Collectively Pre-Market

As of 16:13 Malaysia time, $Advanced Micro Devices, Inc. AMD$ up more than 8%, $NVIDIA Corporation NVDA$ and $Broadcom Limited AVGO$ rose more than 4%, $Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR TSM$, $Arm Holdings Ltd. ARM$, $Micron Technology, Inc. MU$, $Marvell Technology Group Ltd. MRVL$ rose more than 3%, $QUALCOMM Incorporated QCOM$ , $STMicroelectronics NV ADR RegS STM$ rose more than 2%, $ON Semiconductor Corporation ON$ and $Texas Instruments Incorporated TXN$ , $Intellicheck Mobilisa, Inc. IDN$ up more than 1%. Read in detail>>

AMD Partners with Microsoft, Meta, Google on AI Accelerator Standard to Challenge Nvidia

Advanced Micro Devices Inc. ($Advanced Micro Devices, Inc. AMD$) has teamed up with Microsoft Corp. ($Microsoft Corporation MSFT$), Meta Platforms Inc. ($Meta Platforms META$), and Alphabet Inc. ($Alphabet Inc. Class A GOOGL$) ($Alphabet Inc. Class C GOOG$) to develop a new AI accelerator standard, a move that could potentially disrupt the AI hardware market. Read in detail>>

AMD's Lisa Su Optimistic on Product Positioning in Nvidia, ARM PC Battle Despite Market Share Gap

Advanced Micro Devices, Inc. ($Advanced Micro Devices, Inc. AMD$) CEO Lisa Su, on Tuesday, acknowledged the company’s underrepresentation in the PC market but expressed confidence in its product positioning. Read in detail>>

Microsoft CEO: Copilot Drives 40% of GitHub Revenue Growth, Empowers Natural Language App Creation

Microsoft Corporation ($Microsoft Corporation MSFT$) on Tuesday revealed that its AI-powered developer tool, Copilot, has played a significant role in GitHub’s revenue growth. Read in detail>>

Tesla's Head of Regulatory Points Leaves

Earlier this week, Ashlee Ramanathan, a senior associate in charge of regulatory credits at Tesla ($Tesla Motors, Inc. TSLA$), announced her departure on social media, days after Tesla reported second-quarter revenue of US$890 million from sales of regulatory credits. Read in detail>>

Boeing Climbs Pre-Market on Earnings, CEO Appointment

Boeing Co. ($Boeing Company BA$) shares rose in pre-market trading after the company reported Q2 results and appointed a new CEO. The aerospace giant posted an adjusted free cash flow of -US$433 million, better than the expected -US$434 million. The company has also named Kelly Ortberg as its new CEO, replacing Dave Calhoun.

V. Calendar

Earnings:

$Meta Platforms META$

$MasterCard Incorporated Class A MA$

$T-Mobile US, Inc. TMUS$

$QUALCOMM Incorporated QCOM$

$Lam Research Corporation LRCX$

$Boeing Company BA$

$Automatic Data Processing, Inc. ADP$

$KKR & Co. L.P. KKR$

$Altria Group, Inc. MO$

$Marriott International, Inc. Class A MAR$

$Hess Corporation HES$

$Kraft Heinz Company KHC$

$eBay Inc. EBAY$

Expected IPO:

Please note that the timing of IPOs is subject to change at any time (including being advanced or delayed). Investors should therefore keep up-to-date with relevant news.

Events:

| Malaysia Time | Event | Previous | Consensus | Forecast |

| 08:15 PM | ADP Employment Change JUL | 150K | 150K | 140.0K |

| 09:45 PM | Chicago PMI JUL | 47.4 | 44.5 | 47.8 |

| 10:00 PM | Pending Home Sales MoM JUN | -2.10% | 1.30% | 0.80% |

| 10:00 PM | Pending Home Sales YoY JUN | -6.60% | -2.00% | |

| 10:30 PM | EIA Reports JUL/26 | |||

| 02:00 AM +1 | Fed Interest Rate Decision | 5.50% | 5.50% | 5.50% |

| 02:30 AM +1 | Fed Press Conference |

Finally, just a little reminder:

The regular trading hours for US stocks in the Daylight Saving Time (DST) are from 21:30 to 04:00+1 GMT+8, with pre-market trading available from 16:00 to 21:30.

Have a nice trading day!

Disclaimer:

The content is provided as general information only and should not be taken as investment advice. All the contents shall not be taken as a recommendation to buy or sell any security or financial instruments. Any action you take resulting from information, analysis, or commentary on this article is your responsibility. Please consult your investment advisor before making any investments.

Stay informed with updates through our Telegram and WhatsApp channels

Scan QR to join

Telegram