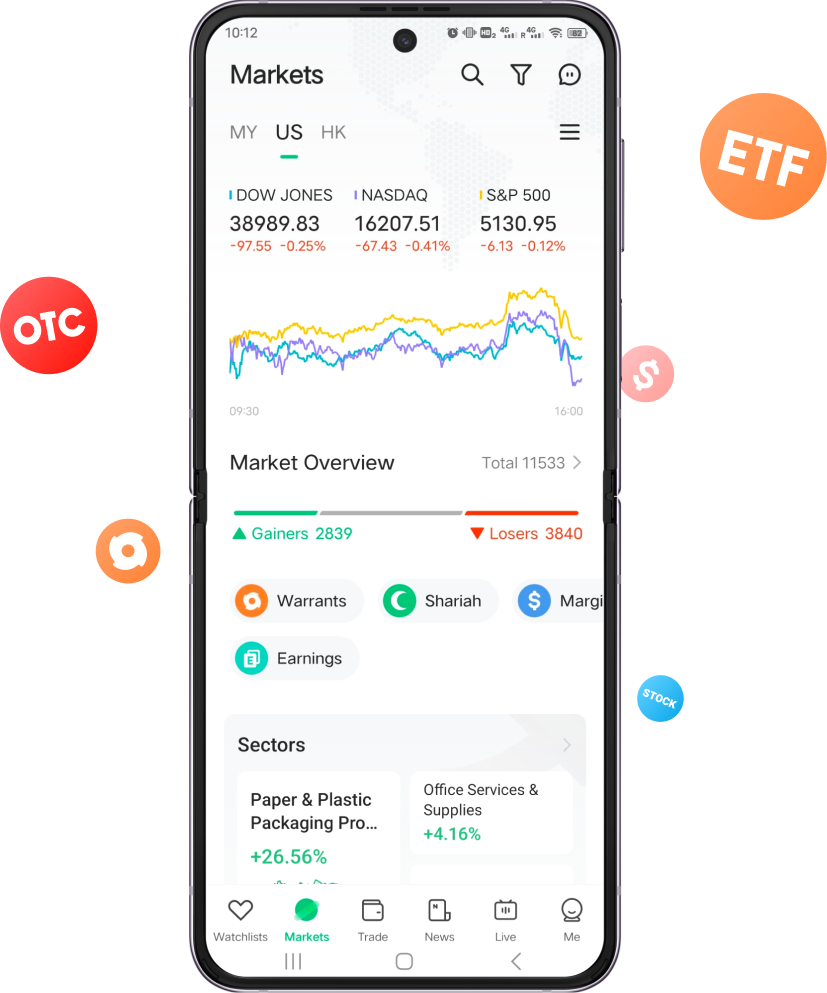

Gain access to the markets of Malaysia, the United States, and Hong Kong with a trusted investment broker.

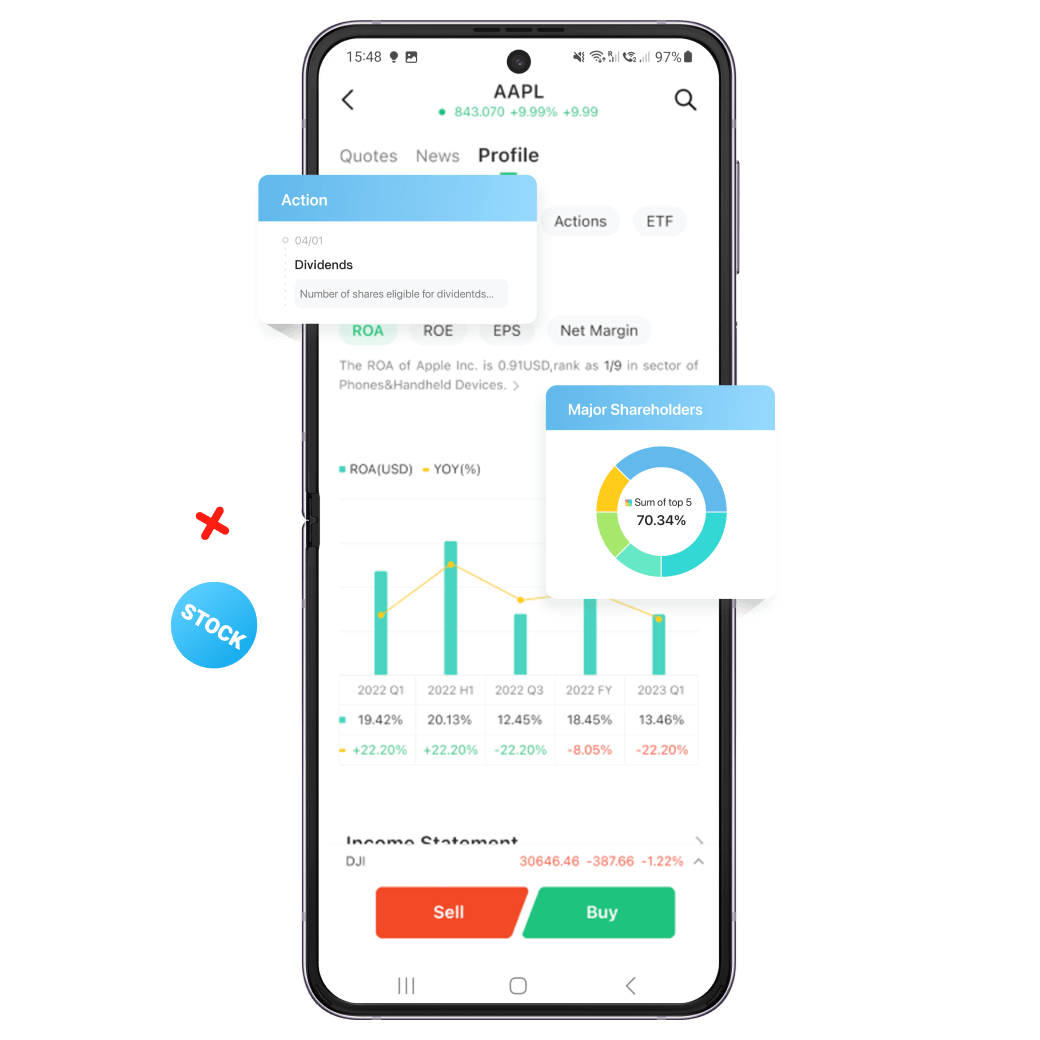

Unlock a world of opportunities and secure shares in your favourite companies.

Start your trading journey with our Universal Account and set sail for victory.

Trade seamlessly on any device, anytime

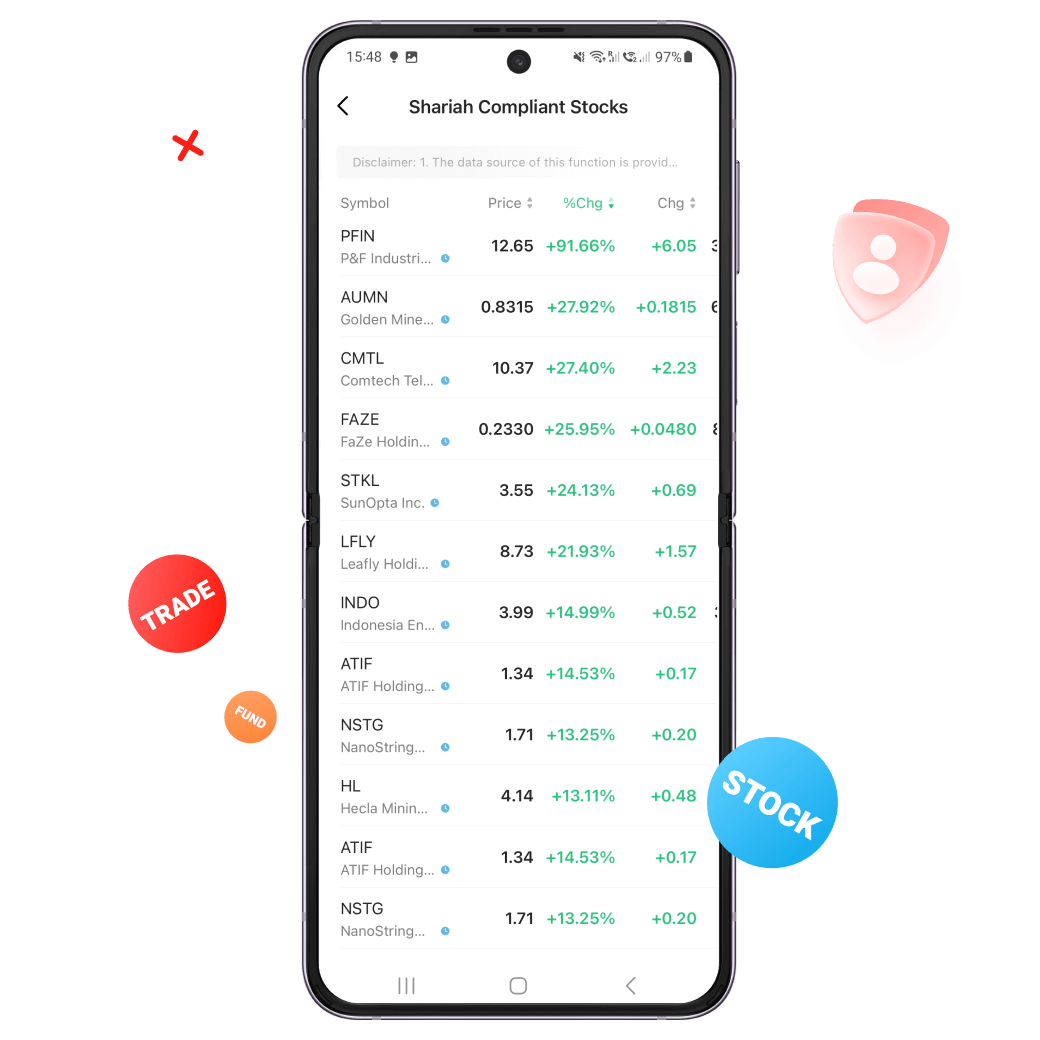

Your Shariah-compliant investing journey starts here

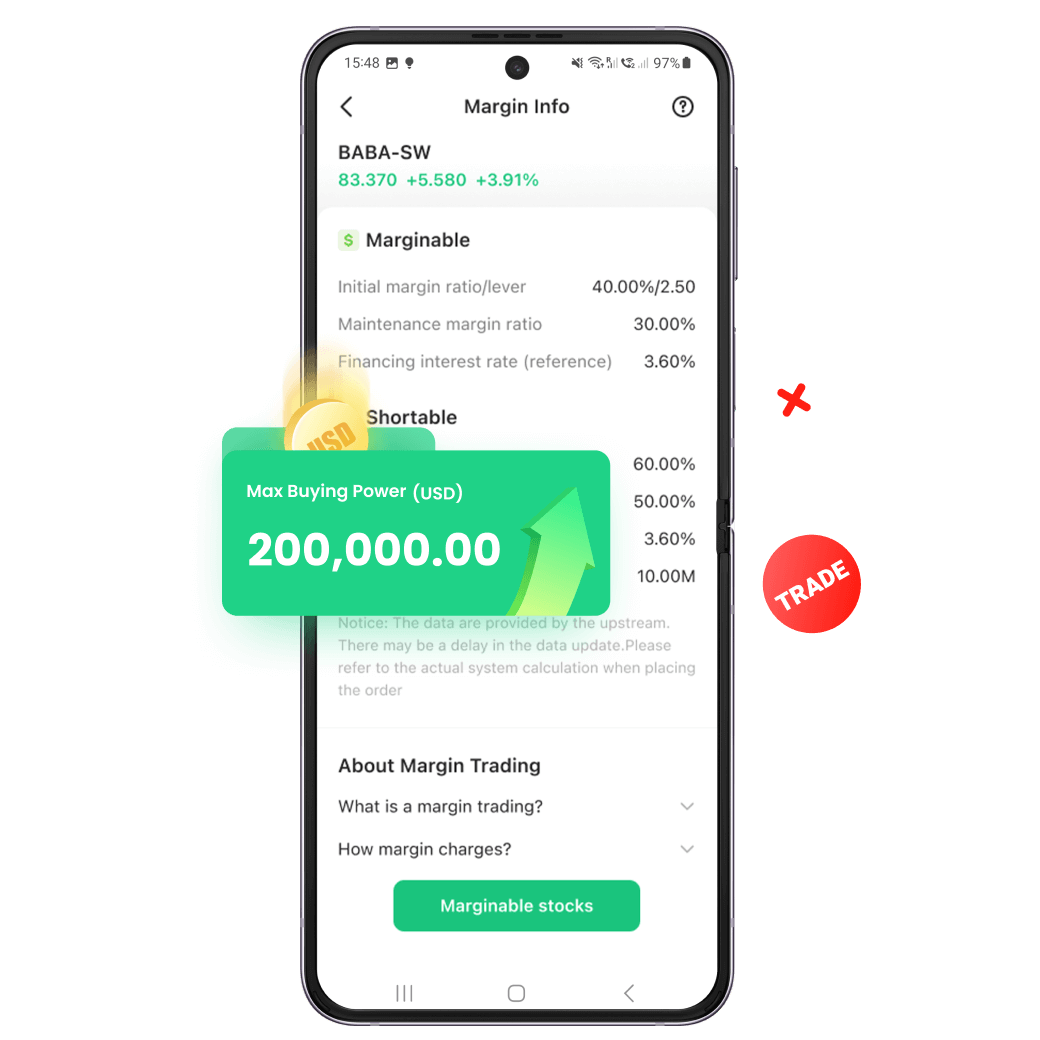

Your funds, trades, and portfolio are secure with us

A team of 200+ licensed Dealer Representatives, combined with a groundbreaking app for a truly unique experience

suite of services

Stay ahead with real-time data and access to 7,000+ stocks in the US market, 3,000+ stocks in the HK market, and all stocks in the MY market with 24-hour online customer service support.

Download Now

Stay ahead of the curve with our comprehensive coverage of global market news.