Key Takeaways

- CPI Relief Sparks Talk of Fed Cuts by July

- Walmart Rallies After Sam's Club and Global Advertising Business Shine in Q1

- Cisco Pops as Company Ups Guidance on the Back of Q3 Results

- JD.com's Stock Rises Pre-market as Revenue And EPS Beat

I. Market Report

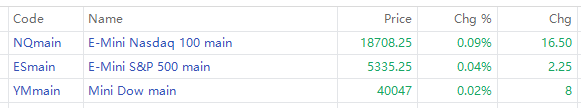

Stock futures rose marginally Thursday after a lighter-than-expected inflation reading propelled the major averages to record highs.

As of 08:14 am, EST (or 20:14 in Malaysia), futures tied to the Dow Jones Industrial Average and S&P 500 futures were both fractionally higher, while Nasdaq-100 futures rose 0.09%.

II. Market Movers

As of 08:10 am, EST (or 20:10 in Malaysia), top pre-market movements are as follows:

| Ticker | Chg. | Company |

| GWAV | 92.3% | $Greenwave Technology Solutions Inc GWAV$ |

| JDZG | 86.97% | $Jiade Ltd. JDZG$ |

| CRKN | 78.13% | $Crown ElectroKinetics Corp. CRKN$ |

| KULR | -29.07% | $KULR Technology Group Inc KULR$ |

| SLNA | -25% | $Selina Hospitality PLC. Ordinary Shares SLNA$ |

| SPIR | -22.4% | $Spire Global, Inc. Class A Common Stock SPIR$ |

Note: We are pleased to inform you that our app now supports pre/after-market trading for US stocks. The trading hours for these sessions are as follows:

- Pre-market: 16:00 to 21:30 in Malaysia

- After-hours market: 04:00 to 08:00 the next day in Malaysia

Please note that regular trading hours are from 21:30 to 04:00 UTC.

III. Flash Headlines

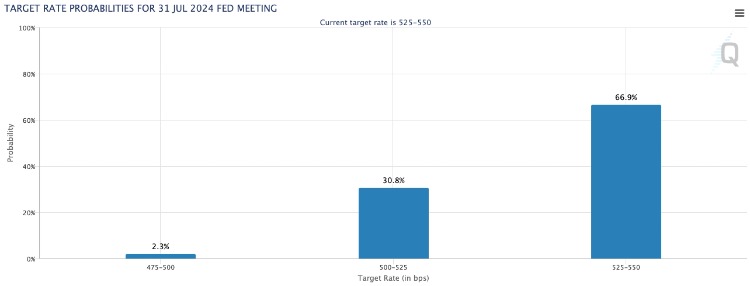

CPI Relief Sparks Talk of Fed Cuts by July

The easing of monthly CPI gains last month brought relief after three months of persistent price increases, particularly in services and shelter inflation. Annual core and headline CPI inflation dropped to 3.6% and 3.4%, respectively. Chicago Fed President Austan Goolsbee welcomed the decline in housing inflation, expressing optimism about the ongoing downward trend. Futures indicate two quarter-point Fed rate cuts this year, with a first move likely by September and a possible cut as soon as July.

Fed’s Williams Calls April Inflation 'Positive'

New York Federal Reserve President John Williams termed April’s USA inflation data as “positive” but advised against overemphasis on short-term trends. He noted slower-than-expected decreases in shelter costs and highlighted the tight labor market. He provided no timeline for interest rate cuts.

Schumer Leads Push for $32B AI Investment

A bipartisan group of U.S. senators, led by Senate Majority Leader Chuck Schumer, released the "AI Policy Roadmap" report on May 15, urging Congress to legislate measures to mitigate AI's potential risks and fund research to boost the economy and national security. The group recommends increasing federal non-defense AI innovation spending to at least $32 billion annually, covering initiatives from designing high-end AI chips to local election projects and various "AI Grand Challenge" programs.

IV. Stocks to Watch

JD.com's Stock Rises Pre-market as Revenue And EPS Beat

JD.com, Inc. ($JD.com, Inc. Sponsored ADR Class A JD$ ) reported fiscal first-quarter 2024 revenue growth of 7% year over year to $36.02 billion, beating the analyst consensus estimate of $35.62 billion.

JD posted an adjusted net income per ADS of $0.78, beating the analyst consensus estimate of $0.64. The stock price gained 3.8% as of 19:50 GMT+8 after the results.

Walmart Rallies After Sam's Club and Global Advertising Business Shine in Q1

Walmart ($Wal-Mart Stores, Inc. WMT$ ) climbed over 5% pre-market on Thursday after topping consensus estimates with its Q1 earnings report.

Comparable sales in the U.S. rose 3.8% to top the consensus estimate of 3.4%. Transactions were 3.8% higher during the quarter, and the average ticket was flat compared to a year ago. E-commerce sales rose 21% during the quarter and contributed 280 basis points to comparable sales. Comparable sales were 4.4% higher for the Sam's Club chain off transaction growth of 5.4%.

Berkshire Unveils $6.7B Chubb Stake, Shares Surge

Warren Buffett’s Berkshire Hathaway Inc. revealed a $6.7 billion stake in insurer Chubb Ltd. $Chubb Limited CB$ , ending speculation over its undisclosed financial firm investment. The stake, accumulated since 2023, was disclosed in a recent SEC filing. Chubb's stock surged 8% in premarket trading today.

Baidu Rises After Q1 Beat as AI Cloud Sales Grow

Baidu's ($Baidu, Inc. Sponsored ADR Class A BIDU$ ) stock rose about 2% premarket on Thursday after first quarter results beat estimates. Baidu's non-GAAP earnings per American depositary share, or ADS, rose 24% year-over-year to RMB19.91, $2.76. Meanwhile, total revenue rose 1% year-over-year to RMB31.51B, or $4.37B. Both top and bottom line surpassed analysts estimates. The company's core online marketing revenue remained stable, while its AI Cloud revenue grew during the quarter.

Cisco Pops as Company Ups Guidance on the Back of Q3 Results

Cisco Systems ($Cisco Systems, Inc. CSCO$ ) shares rose 3% pre-market as of 20:00 GMT+8 after the networking giant reported fiscal third-quarter results and guidance that topped expectations.

For the full-year, Cisco now sees revenue between $53.6B and $53.8B, up from a prior range of $51.5B to $52.5B. Analysts expected $53.63B in full-year sales.

ZTO Express Surges 12% Pre-market, Beating Top-Line and Bottom-Line Estimates

ZTO Express ($ZTO Express (Cayman) Inc. Sponsored ADR Class A ZTO$ ) has reported its first quarter results with Non-GAAP EPADS of $0.37, surpassing expectations by $0.05. The company achieved revenue of $1.38 billion, marking a 10.9% year-over-year increase and exceeding estimates by $100 million. Adjusted EBITDA reached $507.0 million, reflecting a growth of 16.8% compared to the same period in 2023. Parcel volume rose to 7,171 million, up by 13.9% from 6,297 million in the corresponding period of 2023. The company's pickup and delivery outlet count surpassed 31,000 as of March 31, 2024. The stock surged 12% pre-market.

V. Calendar

Earnings:

$Wal-Mart Stores, Inc. WMT$

$IQIYI, INC. IQ$

$Xunlei Ltd. ADR XNET$

$Applied Materials, Inc. AMAT$

$JD.com, Inc. Sponsored ADR Class A JD$

$Baidu, Inc. Sponsored ADR Class A BIDU$

Expected IPO:

----

Please note that the timing of IPOs is subject to change at any time (including being advanced or delayed). Investors should therefore keep up-to-date with relevant news.

Events:

20:30 GMT+8 USD Building Permits (Apr)

20:30 GMT+8 USD Continuing Jobless Claims

20:30 GMT+8 USD Export Price Index (MoM) (Apr)

20:30 GMT+8 USD Housing Starts (MoM) (Apr)

20:30 GMT+8 USD Housing Starts (Apr)

20:30 GMT+8 USD Import Price Index (MoM) (Apr)

20:30 GMT+8 USD Philly Fed Employment (May)

21:15 GMT+8 USD Industrial Production (YoY) (Apr)

21:15 GMT+8 USD Industrial Production (MoM) (Apr)

22:00 GMT+8 USD Fed Vice Chair for Supervision Barr Speaks

22:30 GMT+8 USD FOMC Member Harker Speaks

23:15 GMT+8 USD Atlanta Fed GDPNow (Q2)

23:30 GMT+8 USD FOMC Member Mester Speaks

Read more on the full week's calendar: The Week Ahead: US CPI, Earnings for WMT, HD, BABA And CSCO

Finally, just a little reminder:

The regular trading hours for US stocks in the Daylight Saving Time (DST) are from 21:30 to 04:00+1 GMT+8, with pre-market trading available from 16:00 to 21:30.

Have a nice trading day!

Disclaimer:

The content is provided as general information only and should not be taken as investment advice. All the contents shall not be taken as a recommendation to buy or sell any security or financial instruments. Any action you take resulting from information, analysis, or commentary on this article is your responsibility. Please consult your investment advisor before making any investments.

Stay informed with updates through our Telegram and WhatsApp channels

Scan QR to join

Telegram