Key Takeaways

- US April CPI Is 3.4% YoY, Meeting Expectations

- Analyst Views Meme Stocks Reflect Strong Risk-On Appetite

- Amazon Web Services Undergoes Leadership Change, Matt Garman to Take Over as CEO

- NIO Moves Higher After J.P. Morgan Pulls Lear Rating

- Faraday Future Soars 110% in Pre-Market Trading, Closed Tuesday with a 367% Gain

I. Market Report

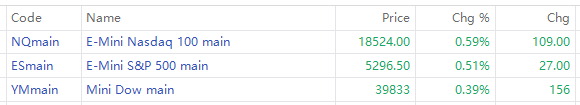

Stock futures rose Wednesday, after the latest consumer price index reading came in lighter than expected.

As of 08:33 am, EST (or 20:33 in Malaysia), futures tied to the Dow Jones Industrial Average added 156 points, or 0.39%, while S&P 500 futures and Nasdaq-100 futures respectively gained 0.51% and 0.59%.

II. Market Movers

As of 08:15 am, EST (or 20:15 in Malaysia), top pre-market movements are as follows:

| Ticker | Chg. | Company |

| SINT | 118.18% | $SiNtx Technologies, Inc. - Common Stock SINT$ |

| FFIE | 112.2% | $FARADAY FUTURE INTELLIGENT ELEC INC FFIE$ |

| GWAV | 54.83% | $Greenwave Technology Solutions Inc GWAV$ |

| VRPX | -58.08% | $Virpax Pharmaceuticals Inc Ordinary Shares VRPX$ |

| DLO | -30.42% | $DLocal Limited DLO$ |

| BOLT | -29.56% | $Bolt Biotherapeutics, Inc. BOLT$ |

Note: We are pleased to inform you that our app now supports pre/after-market trading for US stocks. The trading hours for these sessions are as follows:

- Pre-market: 16:00 to 21:30 in Malaysia

- After-hours market: 04:00 to 08:00 the next day in Malaysia

Please note that regular trading hours are from 21:30 to 04:00 UTC.

III. Flash Headlines

US April CPI Falls as Expected

The US April CPI meets expectations, with a non-seasonally adjusted annual rate of 3.4%, down from 3.5% in March. Core CPI drops to 0.3%, hitting a low not seen since December. Short-term rate futures rise post-release, as traders bet on Fed rate cuts.

Meanwhile, retail sales advanced stalled M/M in April at $705.2B, weaker than the 0.4% increase expected and decelerating from the +0.6% pace (revised from +0.7%) in March. From a year ago, retail sales gained 3.04%.

Analyzing Potential Outcomes of 3 CPI Scenarios

Sevens Report Research's Tom Essaye analyzes potential outcomes of April's Consumer Price Index (CPI) data: dire, unfavorable, and favorable. Market reactions depend on core CPI levels: above 3.9% may trigger strong selling, 3.7-3.8% could lead to moderate selling, while below 3.6% may sustain the market rebound.

Analyst Views Meme Stocks Reflect Strong Risk-On Appetite

The S&P 500's future trajectory hinges on upcoming CPI and retail sales data. Analyst Adam Kobeissi remains bullish, citing AI-hype and resilient Big Tech. He advises buying the trend but warns of larger swings, anticipating dips to be bought. Meme stocks' resurgence won't heavily impact the S&P 500, reflecting strong risk-on investment appetite.

IEA Cuts 2024 Oil Demand Forecast, Supply to Remain Steady

The International Energy Agency (IEA) lowers its 2024 oil-demand growth forecast to 1.1 million barrels/day from 1.2 million, citing subdued industrial activity and mild weather in Europe. OECD demand contracted in Q1, with resilient non-OECD demand. IEA predicts a 2025 supply of 104.5 million barrels/day.

Copper Futures Surge as Short Squeeze Sparks Shipping Rush

The squeeze in short positions sparks a rush to ship copper to the USA, driving New York's July futures to record highs. The surge, over 7% this week, sees unprecedented premiums and active trading on COMEX. StoneX Group's Michael Cuoco notes short covering and forced liquidation.

JPMorgan CEO Calls for Engagement with China Amidst Global Turmoil

JPMorgan CEO Jamie Dimon urges comprehensive engagement with China despite tough competition, emphasizing the significance of geopolitics over the economy amidst global tensions. Dimon advocates for collaboration with allies and expresses concern over the US fiscal deficit, foreseeing potential market repercussions.

IV. Stocks to Watch

Tesla CEO Elon Musk Says China Is 'Awesome' After Biden Escalates EV Tariff Battle

Tesla Inc ($Tesla Motors, Inc. TSLA$ ) CEO Elon Musk on Wednesday commended China and its manufacturing and infrastructure capabilities on the heels of the U.S. quadrupling tariffs on Chinese EVs. The billionaire CEO was responding to a Tesla enthusiast who mocked the irony of the U.S. relying on China for manufacturing but also increasing tariffs on China-made EVs, citing risks to domestic EV makers. “China is awesome. Those who have not visited have no idea,” Musk wrote. “Compare high speed rail there and here.”

Amazon Web Services Undergoes Leadership Change, Matt Garman to Take Over as CEO

Matt Garman will succeed Amazon $Amazon.com, Inc. AMZN$ Web Services CEO Adam Selipsky, effective June 3, Bloomberg reports. Garman is the Amazon cloud unit's leading sales and marketing executive. Selipsky led AWS since 2021. The cloud unit accounts for most of Amazon's profit. In April, AWS initiated global job cuts involving several hundred positions.

NIO Moves Higher After J.P. Morgan Pulls Bear Rating

J.P. Morgan upgraded NIO ($NIO NIO$ ) to a Neutral rating after having the electric vehicle stock set at Underweight. The firm pointed to new initiatives and near-term events in turning more constructive on the upside. In particular, NIO is seen benefiting from its battery service strategy and the Chinese government's policy to boost auto demand. The firm forecasts NIO's monthly unit sales will expand from 15K in Q2 to up to 23K in Q4, and set a stock price target of $5.40. The stock surged by 2.4% pre-market as of 20:00 GMT+8.

Vodafone Rises Over 4% in Pre-Market Trading, Initiates a €500 Million Share Buyback Program

As of 20:10 GMT+8, Vodafone ($Vodafone Group Plc Sponsored ADR VOD$ ) surged by over 4% pre-market. In the news, Vodafone announced the final approval of the sale of its Vodafone Spain unit to Zegona Communications. The completion date for the transaction is set for the end of May 2024, and it will generate 4.1 billion euros in cash and 900 million euros in redeemable preference shares. Additionally, Vodafone has initiated a 5 billion euro share buyback program, which is the first stage of a plan to return 20 billion euros to shareholders over the next 12 months.

Faraday Future Soars 110% in Pre-Market Trading, Closed Tuesday with a 367% Gain

Faraday Future $FARADAY FUTURE INTELLIGENT ELEC INC FFIE$ saw another surge of 110% in pre-market trading, following a staggering 367% increase in its stock price yesterday. The electric vehicle (EV) company’s shares continue to soar alongside the Roaring Kitty meme rally. Investors will note that this action could be the result of a short squeeze of FFIE shares. We saw the potential for this yesterday with more than 1.5 billion units changing hands. For comparison, the company’s daily average trading volume is about 65.6 million shares.

V. Calendar

Earnings:

Expected IPO:

$Kindly MD, Inc. KDLY$

$Jiade Ltd. JDZG$

Please note that the timing of IPOs is subject to change at any time (including being advanced or delayed). Investors should therefore keep up-to-date with relevant news.

Events:

20:30 GMT+8 USD Core CPI (YoY) (Apr)

20:30 GMT+8 USD NY Empire State Manufacturing Index (May)

20:30 GMT+8 USD Retail Control (MoM) (Apr)

22:00 GMT+8 USD Business Inventories (MoM) (Mar)

22:00 GMT+8 USD Fed Vice Chair for Supervision Barr Speaks

22:00 GMT+8 USD Retail Inventories Ex Auto (Mar)

22:30 GMT+8 USD Cushing Crude Oil Inventories

Read more on the full week's calendar: The Week Ahead: US CPI, Earnings for WMT, HD, BABA And CSCO

Finally, just a little reminder:

The regular trading hours for US stocks in the Daylight Saving Time (DST) are from 21:30 to 04:00+1 GMT+8, with pre-market trading available from 16:00 to 21:30.

Have a nice trading day!

Disclaimer:

The content is provided as general information only and should not be taken as investment advice. All the contents shall not be taken as a recommendation to buy or sell any security or financial instruments. Any action you take resulting from information, analysis, or commentary on this article is your responsibility. Please consult your investment advisor before making any investments.

Stay informed with updates through our Telegram and WhatsApp channels

Scan QR to join

Telegram